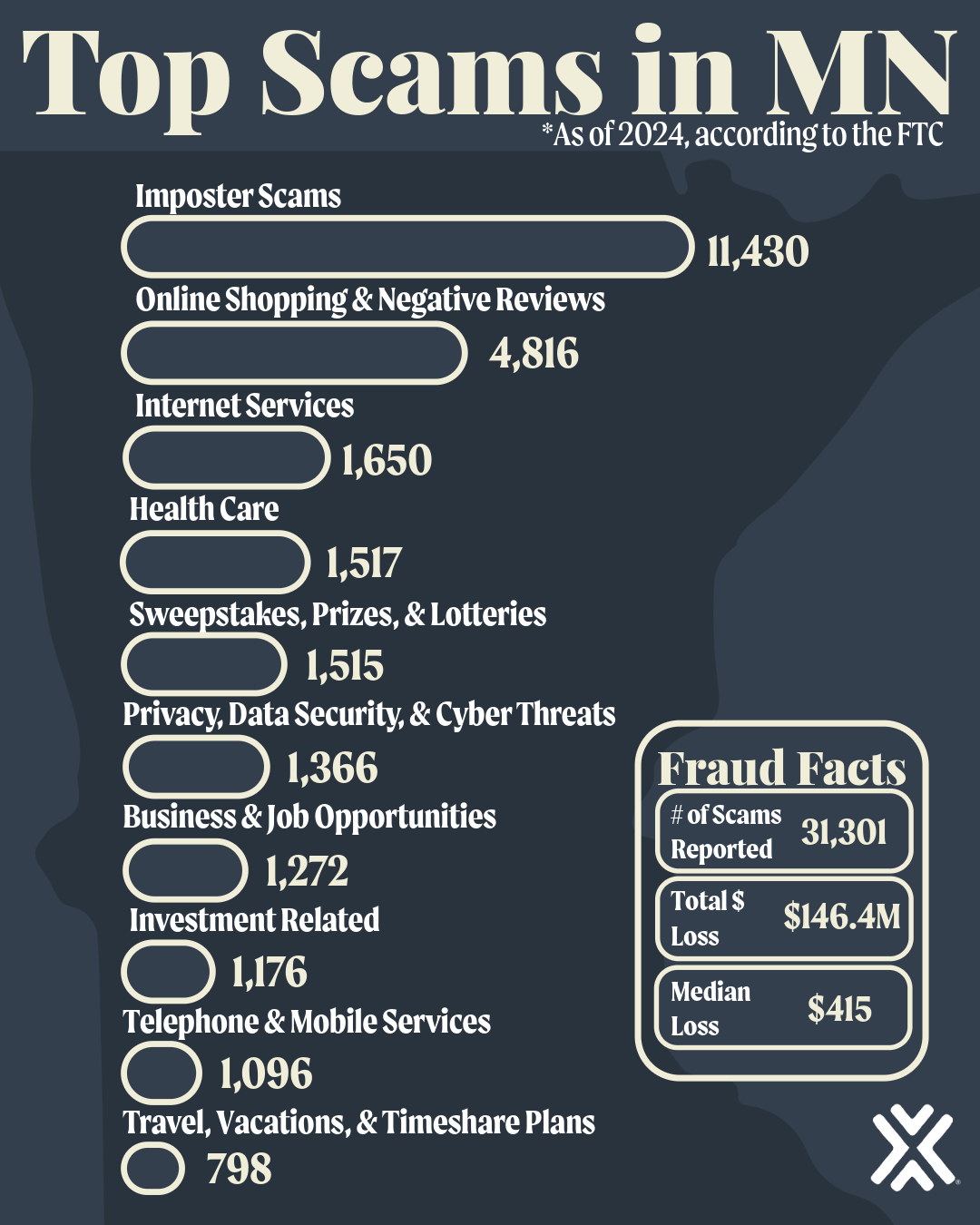

Fraud & Theft Prevention Reduce Risk of ID Theft

Fraud & Theft Prevention Reduce Risk of ID Theft  Common Scams

Common Scams

We Can Help.

-

-9.png) Use the mobile app to set Account Alerts & Card Controls

Use the mobile app to set Account Alerts & Card Controls-

-6.png) Review any pending/posted transactions

Review any pending/posted transactions -

-8.png) Lock any card(s) suspected of fraud

Lock any card(s) suspected of fraud -

-8.png) Call (887)-765-2519 to report a lost or stolen card

Call (887)-765-2519 to report a lost or stolen card -

-8.png) Contact us using our phone numbers or chat online

Contact us using our phone numbers or chat online - Contact Us Here

Recent Spoofing Attempts

September 2, 2025

-

-9.png) Fraudsters are able to get personal information by impersonating our credit union

Fraudsters are able to get personal information by impersonating our credit union-

-6.png) Calls asking for your PIN, SSN, one-time pass for online banking, or other information, HANG UP!

Calls asking for your PIN, SSN, one-time pass for online banking, or other information, HANG UP! -

-8.png) We will never contact you asking for any personal information- if this occurs, contact us immediately

We will never contact you asking for any personal information- if this occurs, contact us immediately

-9.png) Never give out your personal information over the phone

Never give out your personal information over the phone-6.png) Learn how to look for fraudulent websites here:

Learn how to look for fraudulent websites here:-8.png) Report lost or stolen checks or cards immediately

Report lost or stolen checks or cards immediately-8.png) Review card/check deliveries to ensure none were stolen in

transit

Review card/check deliveries to ensure none were stolen in

transit-8.png) Request a free credit report: www.annualcreditreport.com

Request a free credit report: www.annualcreditreport.com-8.png) Notify Expedition Credit Union and be suspicious of phone inquiries (e.g. "verify a

statement, or "you've won a prize")

Notify Expedition Credit Union and be suspicious of phone inquiries (e.g. "verify a

statement, or "you've won a prize")-8.png) Shred old financial documents & safely store new ones

Shred old financial documents & safely store new ones-8.png) Never give out your ATM PIN to anyone

Never give out your ATM PIN to anyone-8.png) Review your bills and statements monthly to ensure there are no fraudulent charges

Review your bills and statements monthly to ensure there are no fraudulent charges

- deceptive emails, texts, or calls designed to trick people into revealing sensitive information

- Thieves create false websites to entice customers to enter their personal data.

- To avoid this, make sure you always check the http address. When you get to the page where you're asked to enter personal information, the http should change to https. The "s" stands for secure.

- Similarly, "vishing" uses phone calls—often from automated dialers claiming your credit card was misused to trick you into calling a fake number and revealing your account and credit card details.

- Promises high returns with little or no risk to lure you into fake or deceptive investment opportunities

- Scammers often use pressure tactics, fake credentials, or fabricated success stories to build trust.

- Records everything you type, often on public or shared computers.

- Avoid entering sensitive information on unfamiliar devices and check for any suspicious hardware connected to the computer.

- Steals your card's magnetic strip data, often with ATMs or payment terminals

- To reduce risk, use one card while traveling to quickly spot & report fraud.

- Businesses may create fake profiles or pay people to leave positive reviews on products or services

- To prevent this scam, don't purchase anything where the reviews are overly positive, generic, or lack details.

- Verify seller information is available and accurate, be wary of significantly lower prices than other retailers, and use secure payment methods.

- Please use the secure messaging system through Online Banking when sending account/personal information electronically to the credit union. Email is inherently insecure and unless encrypted, there is a chance it could be intercepted or monitored by hackers.

- Do not reply to or click on a web link in an email that asks for any personal information unless you have initiated contact with the merchant. Be especially cautious about "urgent" emails warning you that your account will be closed unless you confirm your sensitive information. The government and many financial institutions have a policy of not soliciting a consumer's sensitive information through e-mail.

- Before submitting financial information through a website, look for the locked padlock or other security indicator on the browser's status bar or look for "https://" at the beginning of the web address in the browser's address window. The presence of a padlock or similar indicator and the https:// does not guarantee that the web site is legitimate or secure. However, the absence of either the padlock or the https:// does indicate that the web site is not secure and that it may not be legitimate.

- Install and periodically update your firewall, as well as anti-virus, anti-spyware, and anti-spam software. Ensure the software is current and operational. If you have children in the house, consider enabling the available parental controls.

- For more information regarding Identity Theft, visit the Federal Trade Commission Identity Theft website.